Published: 1 January 2026

As Victorians usher in 2026 today, the state finds itself ensnared in a fiscal maelstrom, with the Labor government’s rollout of 21 new or increased fees, taxes, and charges taking effect amid soaring debt and unrelenting cost-of-living pressures. This analysis, drawn from a broad spectrum of Australian media outlets, government documents, and social media discourse on X, reveals a polarised narrative: necessary revenue for infrastructure versus burdensome hikes exacerbating inequality. With state debt projected to climb to $194 billion by 2028-29 and interest payments nearing $29 million daily, the changes spark debate on sustainability and electoral repercussions.

This article adopts a spiral narrative structure, descending from macro contexts to intimate impacts before ascending to future horizons. Readers can navigate rings non-linearly, mirroring the swirling public discourse on X, where frustration boils over into calls for change.

Outer Orbit – The Big Picture (Macro Economic Backdrop)

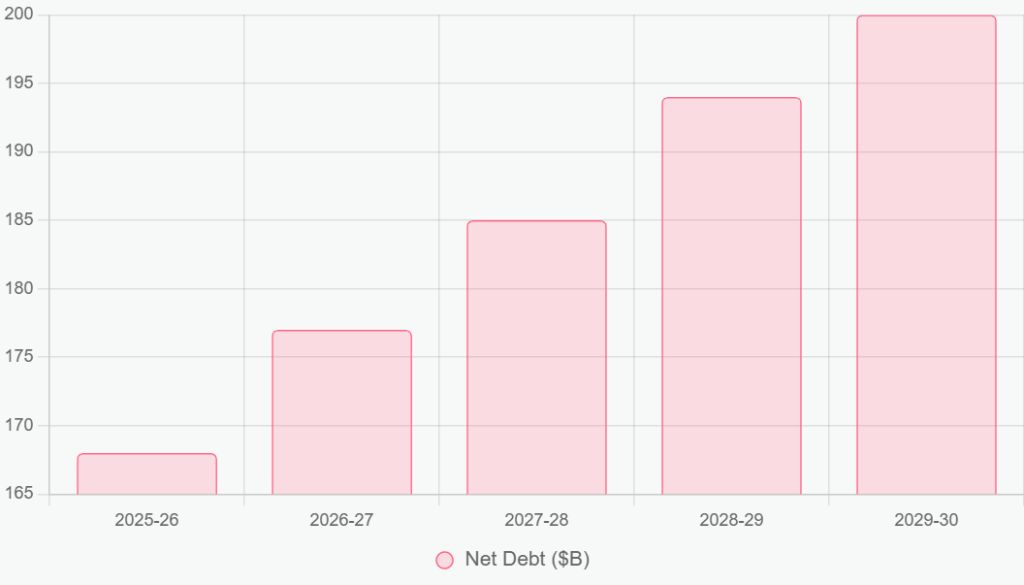

Subsection A: State Debt Eclipse – Overview of Victoria’s $170B+ Debt and $1M/Hour Interest Black Hole

Victoria’s net debt stands at approximately $168 billion for 2025-26, forecasted to escalate to $194 billion by 2028-29, representing about 25% of gross state product. Interest expenses are ballooning, projected at $10.6 billion annually by 2028-29 – equating to roughly $29 million per day or over $1 million per hour in some estimates circulated on social media. This debt trajectory stems from post-pandemic spending and major projects, with auditors warning of heightened fiscal risks amid global uncertainties like interest rate fluctuations.

Subsection B: National Shadows – How Federal Changes Intersect with State Moves

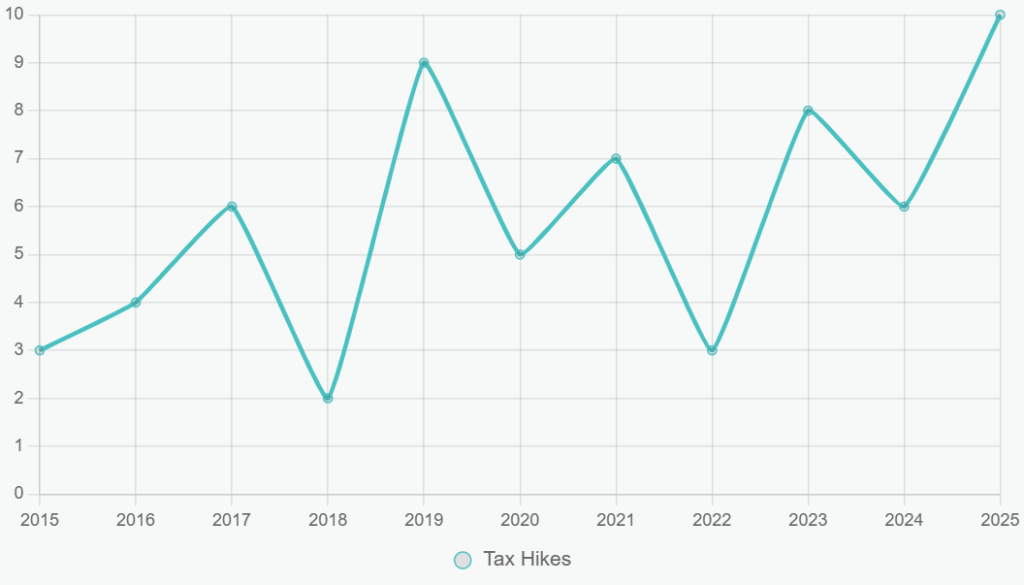

Federally, measures like cheaper medicines under PBS reforms offer minor relief, but state-specific burdens dominate. Victoria’s actions align with broader Australian trends, yet critics highlight the state’s punitive property taxes – now 18 on land alone – as deterrents to housing supply amid a national crisis. Interstate comparisons show Victoria’s debt growth outpacing some peers, with interest burdens rising 64% from 2022-2026.

Visual: Timeline Chart of Tax Hikes Since 2014

Since Labor’s 2014 election, opposition tallies cite 63 new or increased taxes, including property duties, levies, and sector charges. Here’s a line chart depicting approximate annual introductions:

Mid-Swirl – Stakeholder Whirlwinds

The Allan Labor government positions these measures as essential for funding public transport expansions, healthcare, and a $710 million operating surplus in 2025-26, despite risks from new taxes and external shocks. Relief like free public transport for under-18s is touted as saving families $500 million.

Opposition Storm: Liberal Critiques of “Slugging” Victorians and Calls for 2026 Election Upheaval

Liberals decry the 21 changes as the latest in 63 hikes, “slugging” households amid debt mismanagement, predicting electoral backlash in November 2026.

Expert Eddy: Treasury Warnings on Fragile Surpluses; Economists on Inflation Risks

Treasury flags the $710 million surplus as “razor-thin,” vulnerable to tariff impacts and revenue shortfalls, while economists warn of deepened inequality from regressive transport costs.

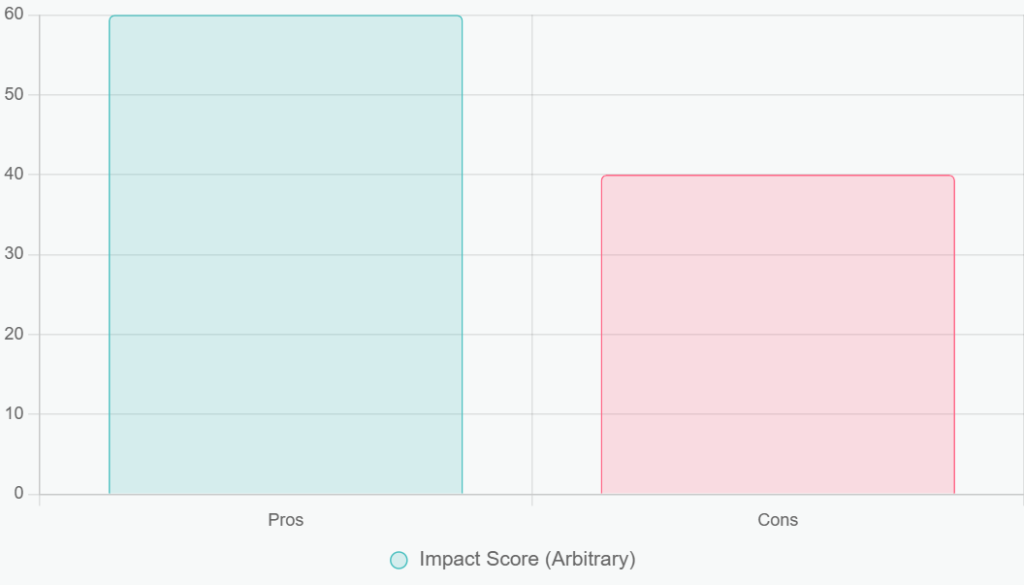

Pros/Cons Balance Scale Infographic

A bar chart weighing benefits (e.g., infrastructure funding) against drawbacks (e.g., higher costs):

Inner Vortex – The Hit List

| Category | Specific Change | Increase/Details | Impact |

| Public Transport | Metro fares | Up 3.6% (e.g., daily full fare: $10 → $10.36) | Higher commuting costs for workers. |

| Public Transport | Weekend/holiday cap | Up 5.3% to $7.60 | Affects families and leisure travel. |

| Road/Driving | CityLink/EastLink tolls | Variable increases | More expensive for drivers. |

| Parking | CBD Congestion Levy (Cat 1) | Up ~73% to $3,030 annually | Targets city businesses/commuters. |

| Property | Vacant Residential Land Tax | New tax introduced, including unimproved land | Discourages empty homes amid housing crisis. |

| Energy | VEU Certificates | Up 87% to $145.10 | Raises home energy efficiency costs. |

| Energy | Energy Acquisition Fees | Up 55% to $1,020 | Impacts utility bills. |

| Relief | Under-18s Public Transport | Free access | Benefits families (~$500M in savings). |

| Relief | Bridge Assessment Fees | Eliminated | Eases burden on the trucking industry. |

(Note: Full list centres on these; revenue not uniformly quantified but offsets like free kids’ travel aim to mitigate.)

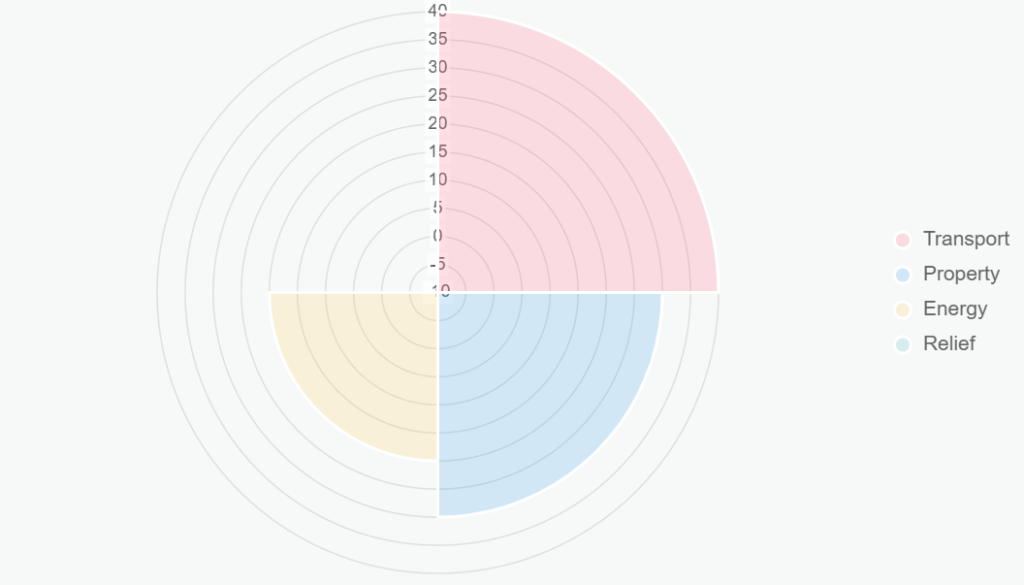

Interactive “Tax Impact Wheel” – Spin to See Effects on Commuters, Homeowners, etc.

A polar area chart illustrating sector impacts:

Eye of the Storm – Personal Ripples

X users vent fury: “60+ new or increased taxes in Victoria, because Labor borrowed record amounts,” laments @thomasthebull. @LT_Aust warns, “The interest Bill will soon hit one million dollars per hour. 2026 is the year we can finally vote this out.” Others decry flow-on effects: “Small businesses can’t afford penalty rates… less money in the economy which means more taxes.”

Forward-Looking Bar Chart Projecting Debt/Revenue to 2030

Bar chart of net debt: